Advertisement

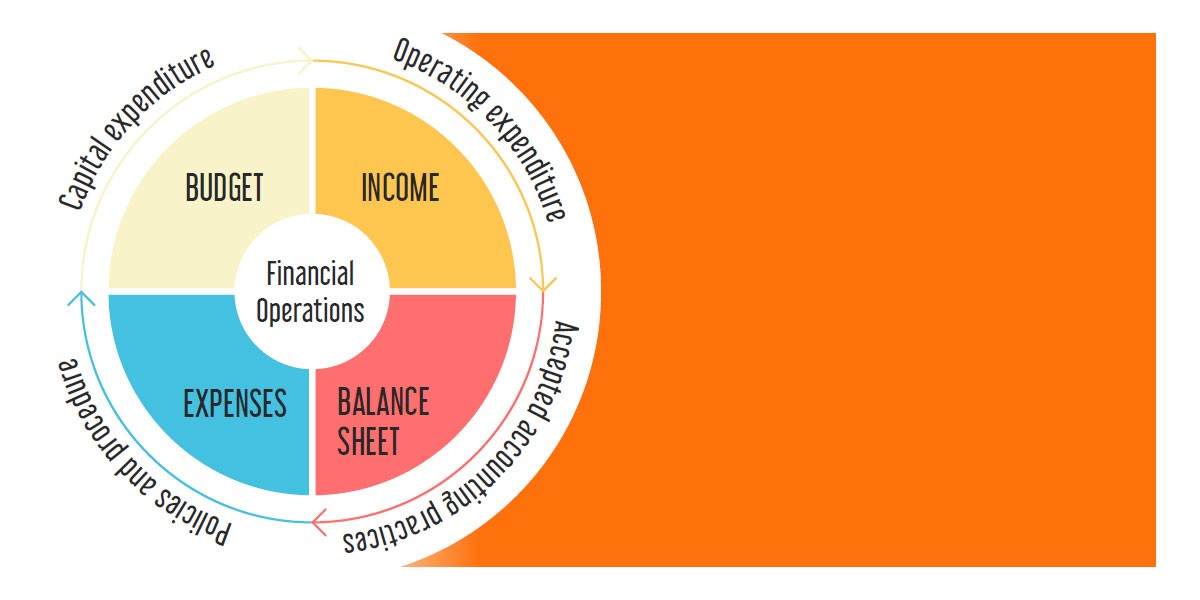

Financial operations are a critical part of the management of any operation, so it is essential that they are carried out with integrity. The board of directors, particularly the financial director, is ultimately responsible for an association’s funds and may not abdicate their fiduciary responsibility.

Introduction to financial operations

Given the reality that community association boards are made up of diverse individuals with varied degrees of financial knowledge, it is important that the policies, procedures and guidelines necessary to ensure sound financial operations be spelled out clearly for all.

Banking

- Maintain the association’s funds, including the replacement fund (commonly called reserves) and operating fund, in separate accounts in the association’s name, and ensure that the board has direct access to the accounts.

- Maintain an operating cash balance of approximately two months’ expenses.

- Reconcile the bank statements and investments monthly (or at least quarterly).

- The board member charged with reviewing the bank statements should not be responsible for payment of bills and/or signing of cheques.

- The full board should review copies of bank statements and investments on a quarterly basis.

- Require at least two board members’ signatures to gain access to reserves.

- Require at least two authorised signatures on all cheques over a predetermined amount, as established by the board of directors.

- Require the board member responsible for a particular portfolio to sign the invoice, and another board member to sign the authority document. If the payment is being done via internet banking, then yet another board member should do the release once the administration office has processed the payment.

Planning

- Establish a long-term financial plan for all assets, and review and revise it annually.

- Develop written, board-approved investment policies and procedures.

- Commission a reserve study and/or update the current reserve study at least every three years and review the report at every annual general meeting.

- Prepare a long-term operating budget covering the next three to five years.

- Include reasonable reserves for future major repairs and replacement of common facilities.

Disclosure

- Provide home owners with reasonably detailed summaries of budget and reserve information on an annual basis, with further information readily available.

- Request financial statements from the manager or accountant at least quarterly.

- Inform home owners when the annual financial statement, which must be prepared in accordance with the basis of accounting used by the association, is available for review.

Policies/Record keeping

- Develop a written, legal, board-approved collection policy for enforcing owners’ levy obligations.

- Establish that the board must approve all write-offs of bad debts in a timely manner.

- Solicit competitive bids for services, and require board authorisation for all expenditures over a predetermined amount.

- Request timely updates and reports from the association’s manager and accountant.

- Keep detailed meeting minutes, paying close attention to all fiscal matters.

- Conduct payroll audits to ensure all employees are legitimate, and paperwork is current and complete.

- Carefully archive all permanent financial records.

Budgeting

- Assign budget items in the month during which the expenses are expected to be incurred rather than dividing total yearly expenses by 12.

- Require board approval for cheques in payment of non-budgeted, non-recurring expenses in excess of an established limit.

- Compare income statement with the budget on a periodic basis (at least quarterly).

- Require board approval for capital expenditure and big contracts – see bid requests, below.

Bid requests and requests for proposals

Management of a community association’s resources frequently involves the use of contracts to obtain the products and services required. Given such, one component of the board’s fiduciary responsibility is to ascertain that the association is not paying too much for the products and services it receives. The most effective way to ensure competitive prices is through bid requests to potential contractors. A bid request or request for proposal (RFP) is an announcement that an organisation is interested in receiving proposals for a particular project or service.

Because of the amount of effort the bidding process requires for both the community association and the bidders, the process should be used only for significant projects or purchases, and for ongoing services such as lawn maintenance. The board of directors should determine the minimum size of a contract that requires competitive bidding. Simply stated, bid requests and RFPs allow the board to solicit competitive prices for products and services, thereby ensuring that the community association obtains the desired services from a quality service provider at a reasonable price.

Financial responsibilities

A community association’s governing documents and management contracts will define formal roles and responsibilities in the budget process. These roles should be communicated in a constructive manner to all involved to ensure that appropriate expectations exist. Below is an outline of the responsibilities of volunteers and professional staff typically charged with developing community association budgets:

- The board of directors is responsible for establishing, approving and monitoring the community’s budget.

- The treasurer or finance director is usually responsible for the preparation and review of the draft budget. He or she typically delegates the initial preparation of the budget to the manager or accountant. If applicable, the treasurer will then review the draft of the budget with the association’s finance committee.

- Owners should be aware of how the association’s finances are being run, and they may need to vote on some things, e.g. a large increase in levies, special levies, capital expenditure improvements or funding reserves. Some associations require that owners vote on budgets.

- The manager’s formal budget responsibilities are listed in the management contract, but they will usually include:

» preparing a draft budget

» reviewing the draft with the treasurer, finance committee (if one exists), and the board

» revising the draft budget after changes are made

» mailing a summary of the proposed budget to owners prior to approval

» mailing copies of the completed budget to all owners and having copies on hand for prospective owners.

Accounting practices and financial statements

There are two commonly used bases of accounting – the accrual basis of accounting, which is required by generally accepted accounting principles (GAAP), and the cash basis of accounting, which is considered to be an other comprehensive basis of accounting (OCBOA). OCBOA is not in accordance with GAAP, which is most often used by community associations.

Generally accepted accounting principles

GAAP accounting provides uniformity among financial statements from different community associations. GAAP requires the use of accrual accounting for annual reports, because it records income when earned and expenses when incurred, so the resulting statements are more useful for comparing the results of the budget to the actual activity. GAAP requires the following set of year-end financial statements for community associations:

Advertisement

- Balance sheet – a summary of a community’s financial position at a specific point in time. The three major components of a balance sheet are:

» assets – items owed to, or owned by, an association

» liabilities – the association’s debts to third parties

» members’ equity – the owners’ interest in the association’s remaining assets after providing for the discharge of its liabilities.

Statement of income and expense – the operating activities for a given period of time, usually one year, ending on the same date as the balance sheet.

Statement of changes in members’ equity (or fund balances) – reconciles the beginning and ending members’ equity with results of operations for the period.

Statement of cash flow – reconciles an association’s operating, investing, and financing activities from the basis of accounting used (generally the accrual basis) to a cash basis, to reflect what caused the changes in the cash balance during the year.

Notes to financial statements – footnotes that provide additional information to help the reader understand the association’s financial situation.

Financial statements and reports

Financial statements are produced to:

- provide their internal and external users with the economic information needed to make appropriate decisions on behalf of the community association

- enable the community association board and manager to control the association’s financial operations.

Year-end financial statements help determine and outline a community association’s fiscal health. Experts suggest that a chartered accountant (CA) specialising in community associations prepare these statements. From the more authoritative (and most expensive) to the least authoritative (and least expensive), these are audits, reviews and compilations.

Audits

An audit is an examination of an organisation’s accounting records and procedures by an independent chartered accountant for the purpose of verifying the fairness of the presentation of financial statements. An association’s governing documents and the national financial regulations require an annual audit of the association’s financial records, which is in any case sound business practice. The audit should include, but is not limited to:

- confirmation of selected transactions and balances with outside parties (such as banks and contractors)

- a physical inspection of records

- a trace of transactions to supporting documentation and authorisation by someone within the association

- review of the association’s legal documents and minutes.

After the audit is complete, the chartered accountant will prepare an opinion report that states one of the following four outcomes:

- The auditor issues an unqualified or clean opinion that states that the financial statements are presented fairly in all material respects.

- The auditor issues a qualified opinion that says the statements, with certain reservations, are fairly presented.

- The auditor disclaims his/her ability to issue an opinion.

- The auditor issues an adverse or negative opinion.

Clearly, a community association should strive for a clean opinion or, if necessary, a qualified opinion. The third scenario – a disclaimer – usually occurs when the client organisation or the circumstances surrounding the audit restrict the CA’s ability to collect sufficient evidence to form an opinion. An adverse opinion is issued when evidence indicates that the financial statements do not fairly reflect the association’s financial position or operating results. Financial experts recommend that a CA familiar with community associations perform an audit annually.

Reviews

A review is less thorough than an audit, thus a less costly analysis of an association’s financial activities. It provides the board with some assurance that the financial statements are consistent with typical trends without the detailed examination obtained in an audit.

Compilations

A compilation is a presentation of financial statements prepared by an accountant, not necessarily a CA, but does not provide any level of assurance regarding the financial statements.

Levies and investments

Levy collection

The association articles and law give associations the authority to collect levies. It is not unusual for a board to be responsible for millions of rand in levy fees. Given their fiduciary responsibility, association boards must collect levies in a timely, systematic manner. Each association should adopt, by resolution, the procedures for the collection of payments (dues or levy fees). The policy should be distributed to all members and uniformly enforced. Communication of the association’s budget is critical to levy collection because those members who understand the association’s financial position are more likely to pay their dues on time.

Investments

Investments involve the purchase of assets with monetary value for the purpose of generating additional value over time. A community association should have a written investment policy, a set of procedures, and checks and balances for ensuring that investments:

-

- are safe, i.e. protecting the principal from risk

- are liquid, i.e. can easily be converted into cash or cash equivalent

- give a good yield, or return on an investment.

Very informative, thank you.