Advertisement

Why Natural Capital Accounting matters for every estate in South Africa.

INTRODUCTION: THE ASSETS WE’VE BEEN MISSING

Estate management are experts at counting what we build: the kilometres of roads to maintain, the buildings, the pumps to service, the stormwater pipes to refurbish, the roofs, fences … to name but a few of the numerous infrastructure elements that anchor our reserve studies. Yet the systems that often deliver the greatest long-term savings – landscaping, wetlands, tree canopies, soil structure, catchments and ecological corridors – rarely appear on our balance sheets.

These natural systems quietly regulate flooding, cool microclimates, stabilise slopes, filter water, reduce irrigation demand and enhance property values. We only notice them when something goes wrong – when a tree dies, a stormwater pond overflows or a slope collapses – and by then the cost of underinvesting in nature arrives with interest. ‘Some of our most valuable estate assets are the ones we’ve never listed.’ Today, estates across South Africa are stepping into a global movement that measures these natural assets with the same discipline we apply to built infrastructure. The emerging tool leading this shift is Natural Capital Accounting (NCA)

What is Natural Capital Accounting?

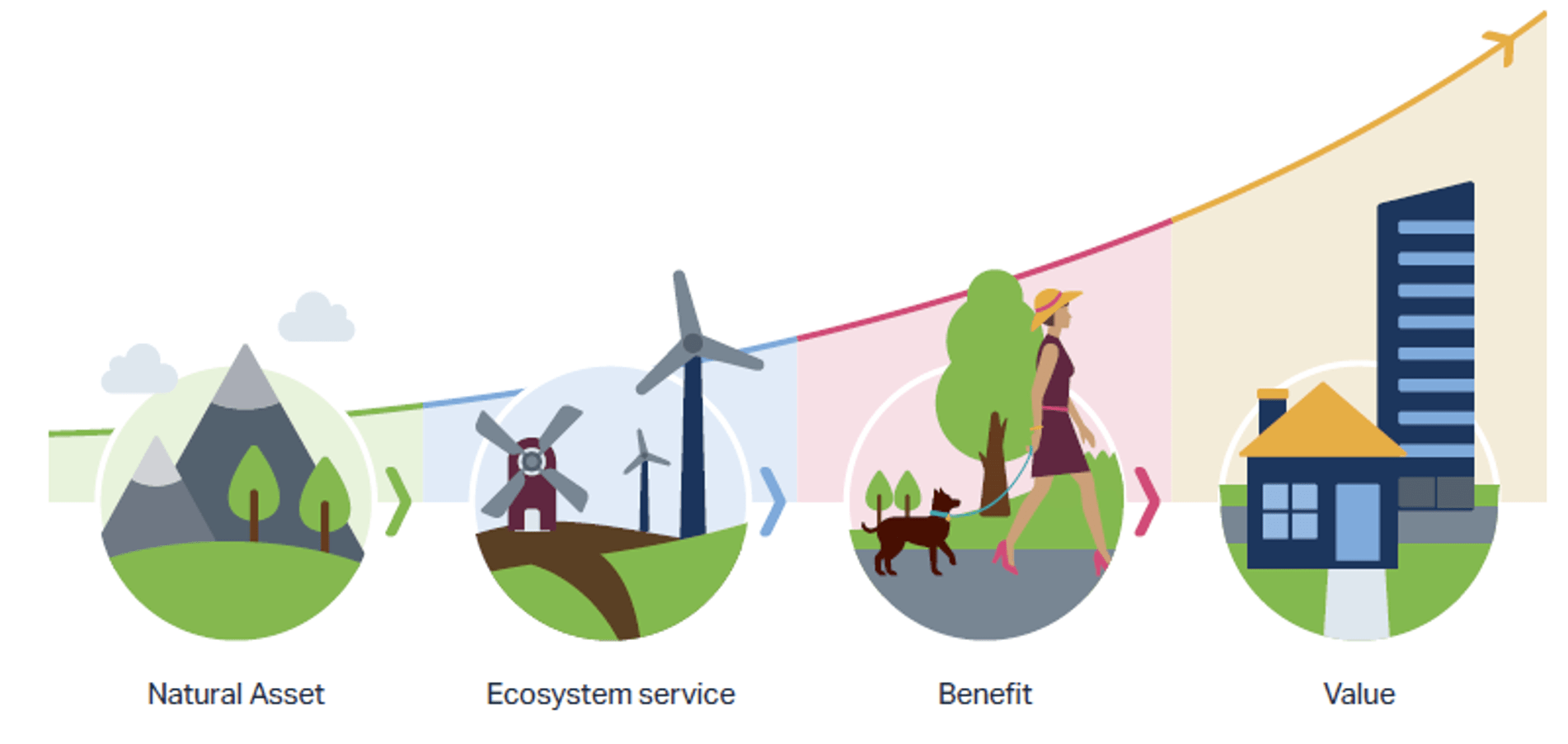

NCA is a structured method for measuring, tracking, and valuing natural assets, everything from wetlands and rivers to tree canopies, grasslands and ecological buffers. It follows the United Nations’ internationally recognised System of Environmental-Economic Accounting (SEEA), which South Africa helped develop through SANBI and Stats SA.

Over the past decade, South Africa has produced world-leading ecosystem accounts, including National River Ecosystem Accounts, Protected Area Accounts, Land and Terrestrial Ecosystem Accounts, Estuary Ecosystem Accounts, and Sub-national Water Resource Accounts for the Berg-Breede and Greater uMngeni catchments.

These accounts, produced through SANBI, Stats SA and global partners, allow decision-makers to track the extent, condition and service flow of ecosystems over time, just as financial accounts track economic performance.

Advertisement

The national and global momentum

The urgency behind NCA is clear. The World Bank warns that collapsing ecosystem services could remove US$2.7 trillion from the global economy by 2030. For biodiversityrich regions like South Africa, GDP losses could be even more significant.

Locally, research presented at the national NCA Forum demonstrates that:

- 30% of South Africa’s economic production depends on water provision and regulation services;

- 20–30% depends on climate regulation and erosion prevention;

- 50% of our ecosystems are already classified as threatened.

The financial, banking, agricultural, and water sectors are rapidly incorporating these findings into risk planning. Estates, which function as ‘mini-cities’, cannot afford to be left behind. ‘Half of South Africa’s ecosystems are threatened – and estates rely on them daily.’

Why NCA matters for estate management

An estate’s sustainability depends on the interaction between built and natural systems. Wetlands mitigate flooding; tree canopies cool and shade the environment; healthy soil reduces water consumption; vegetated slopes prevent erosion; and biodiversity underpins ecological stability. Each of these contributes directly to operating costs, maintenance cycles, resident satisfaction, and long-term resilience

Yet natural systems are almost never included in reserve studies, the primary tool estates use to plan and fund long-term maintenance. This results in a blind spot: we budget to replace pipes, but not to rehabilitate wetlands; we plan for asphalt resurfacing, but not for slope stabilisation; we quantify the cost of pumps, but not the value of tree canopy.

NCA corrects this imbalance by giving estate administration a structured, evidence-based way to track natural assets and integrate them into reserve funding plans.

Real examples: what NCA looks like on the ground

Across South Africa, estates are beginning to quantify the economic and functional value of nature-based systems. At Clara Anna Fontein, for example, a closedloop composting programme not only diverts green waste from landfill but also reduces topsoil importation and fertiliser costs by up to 40%, while improving soil health and reducing irrigation demand. Similarly, functional wetlands can save estates the cost of expensive stormwater upgrades by absorbing peak flows, improving water quality, and reducing downstream erosion.

A healthy tree canopy can reduce surface temperatures by several degrees, lowering irrigation needs and creating more liveable outdoor spaces. Natural vegetation on slopes can significantly reduce the risk of structural failures and sedimentation in stormwater systems. These examples demonstrate that ecological infrastructure is not a luxury; it is infrastructure in the truest sense, performing critical functions at lower cost over time.

Integrating NCA into reserve studies

The national reserve study standards increasingly recognise that infrastructure is no longer only built. Many estates require long-term planning for ecological corridors, wetlands and riparian zones, slopes and erosion-prone areas, tree canopies and urban forests, soil systems and composting loops, and fire-adapted vegetation buffers.

NCA provides the evidence and metrics needed to include these in 10-, 20- and 30-year capital plans. By mapping natural assets, assessing their condition and identifying maintenance needs, estate management can allocate funding cycles with the same accuracy used for roofs or pumps.

A new standard for sustainable estates In a world facing increasing climate volatility – heatwaves, intense rainfall, and water scarcity – estates that invest in natural capital will outperform those that don’t. They will experience fewer infrastructure failures, lower longterm costs, improved resident wellbeing, and stronger property values. NCA gives estate managers a language of evidence: the ability to demonstrate, clearly and credibly, the value of nature to trustees and residents. It turns invisible value into something measurable, monitorable and fundable. ‘If you can measure it, you can manage it – even nature.’’

The future of estate management is living infrastructure

Natural Capital Accounting does not replace the financial rigour of reserve planning; it strengthens it. By recognising ecological infrastructure as part of the estate’s true asset base, managers can plan more effectively, reduce risk and build resilience into every decision. The estates that embrace NCA now will set the benchmark for sustainability, governance excellence and long-term financial stability in South Africa’s residential landscape.