Advertisement

Remember the fable of The Tortoise and the Hare? The one where the arrogant hare thought that he could so easily outrun the tortoise that he decided to have a nap? The slow and steady tortoise just kept going and ultimately won the race.

ETFs (Exchange-traded Funds) are often thought of as the slow and boring investment choice and something that is only relevant to new investors or those who don’t understand the stock market. These often underrated investments are tenacious little beasts, though, and will keep going through thick and thin. While the hare races ahead with Steinhoff shares, thinking that he is bound to win, he seems to be taking a nap right now. The slow and steady tortoise just keeps plodding along, and although it’s impossible to predict the future, your ETF investment won’t let you down.

A brief history

The recent passing of John Bogle on 16 January this year has brought about a renewed interest and discussion on the value of index tracking funds for long-term investing. Bogle, who is best known as the founder and chief executive of The Vanguard Group, created the first publicly traded mutual index fund in 1976, namely First Index Investment Trust.

An index-tracking fund is essentially a fund that tracks a market index such as the JSE All Shares Index (ALSI) or the JSE Top 40 Index. The calculations and terminology can get tricky, but think of the ALSI as a weighted average of all companies listed on the Johannesburg Stock Exchange, and the Top 40 as the weighted average of the top 40 companies. You’re thus able to invest in the average performance of all major South African companies. That is far safer than trying to pick your own ‘best buys’.

Advertisement

ETFs have taken Bogle’s original idea a little further and, instead of only being able to track a market index, ETFs can also track an industry, commodity or even another fund – it’s really a basket of goods, so to speak. ETFs are a relatively new instrument, with the first being introduced to South Africa in 2000 by Satrix, when they launched their Satrix Top 40. We now have well over 60 ETFs to choose from.

The easy option

ETFs make investing easy because you can simply invest in one product that is inherently diversified. You don’t need any great trading skills or knowledge, and there’s no need for you to try and predict the next big ‘winner’. Passively managed ETFs that simply track an index or industry are a little boring, as there is nothing for you – nor your investment manager, come to think of it – to do. That’s why the fees are generally far lower than any actively managed investment, and it’s probably also why your broker wouldn’t ever recommend it to you. There’s so little money in it for the intermediary.

As Bogle says in a 2016 Reuters interview, ‘I swear if a broker calls you up and says “Buy A and sell B,” you’re better off doing the opposite. A broker has to sell you something, or he doesn’t eat at the end of the month. In any trade, there is someone who is right and someone who is wrong. The only one who is always right is the man in the middle. ’Buying ETFs is simple, and can be done through an online platform such as Easy Equities. There’s no need for any expensive trading account or broker.

Economic and political turbulence

ETFs play a highly valuable role in long-term investing, as they mitigate risk over time. As you know, individual share prices rise and fall daily due to the broader economic climate as well as specific company circumstances such as scandals, releasing of financials, or take-overs. With a basket of shares you can spread your risk, and absorb the negative effects far more easily.

Incidentally, you may find a unit trust that tracks the exact same basket of shares or indexes that an ETF tracks, and the growth would therefore be the same. The difference, however, comes down to the fees being charged. A 1% difference compounded over a 30-year period could make a huge difference to your investment, so it’s always important to compare products. Political turmoil and hotly contested elections will most certainly affect your investments, and ETFs are not immune to general market shifts. As we well know, the South African market is currently in a slump, and this year’s elections won’t magically change that. If anything, they may prolong the technical recession.

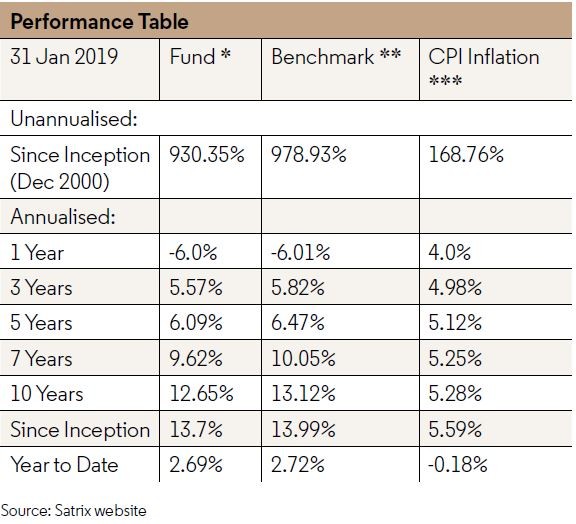

This is very depressing for our investments, and it’s easy to be tempted to cash out and look for alternative options. Looking at the performance of the Satrix Top 40 ETF, the 1.04% growth over the past three years seems pathetic, and the negative growth from the past year is even worse! It’s hard to justify keeping your money invested in something that’s literally shrinking.

Slow and steady to the end

South Africa is experiencing some huge economic challenges, and it depends whom you speak to whether you’ll hear a story of doom and gloom or one of hope for the future. I’m part of the latter group and have a generally optimistic view of the country.

We’re not the only country experiencing economic woes, though – just look at how Brexit is affecting the UK economy, and think about the effects of Trump’s wall. History has shown us time and again that economies change, and that markets rise and fall.

ETFs offer a simple and cost-effective way to invest with moderate gains. And yes, exposing yourself to less risk in the markets does mean potentially fewer gains. More importantly, though, it also means fewer losses. No investment instrument is the be-all and end- all, and including ETFs in your portfolio is adding to diversification, which is key to effective long-term investment. Whether you’re an aggressive investor looking for the next Apple, or someone who simply likes to play on the stock market, consider the long-term value of ETFs in your portfolio, especially in a turbulent climate.